Fake forms and scams have been plaguing the country for some time now. No one is immune from these devious attempts to rob you of your money, not even a law firm. Recently, our firm received a fake form scam in the mail. Instead of immediately shredding it, we figured it would be a perfect opportunity to teach you 10 ways to spot a fake government form scam.

- No Information on the Government Entity

- No Instructions in the Title Box

- Strange Formatting

- No Cover Letter/Returned Form

- Urgent Demands for Payment

- Requesting Previously Filed Identifying Information

- Odd Signature Request

- No Privacy Act/Paperwork Reduction Act Notice

- It’s Confusing/Makes No Sense

- Form Doesn’t Exist

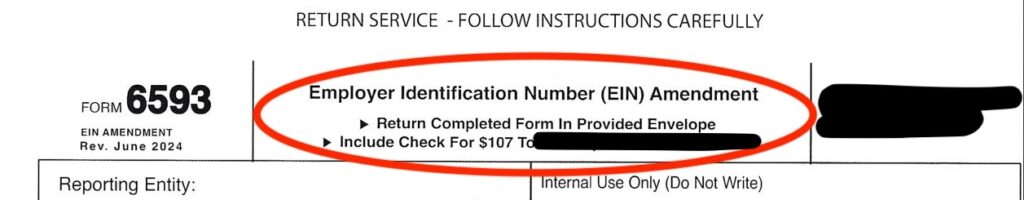

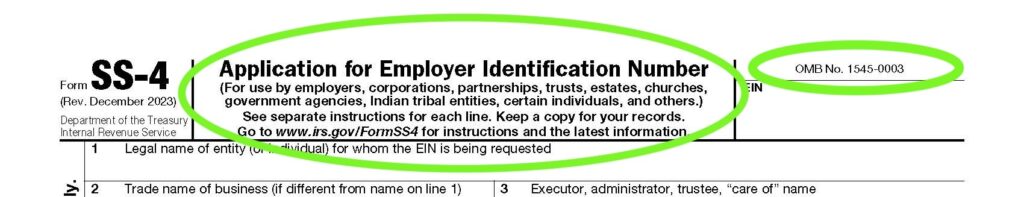

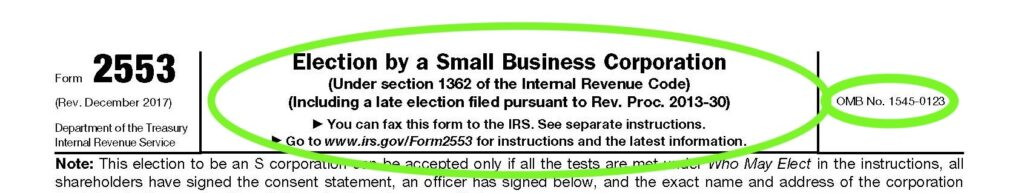

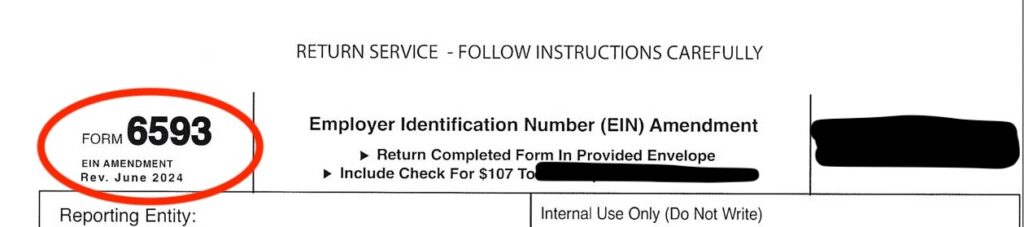

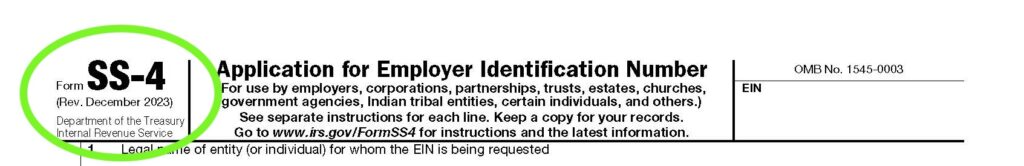

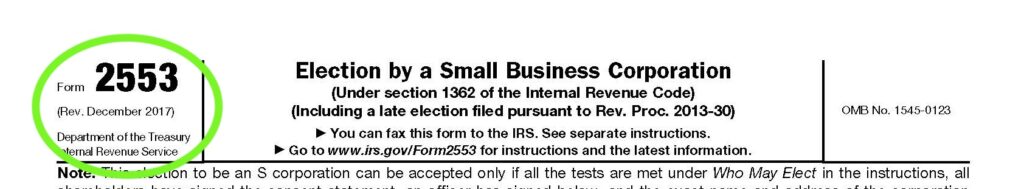

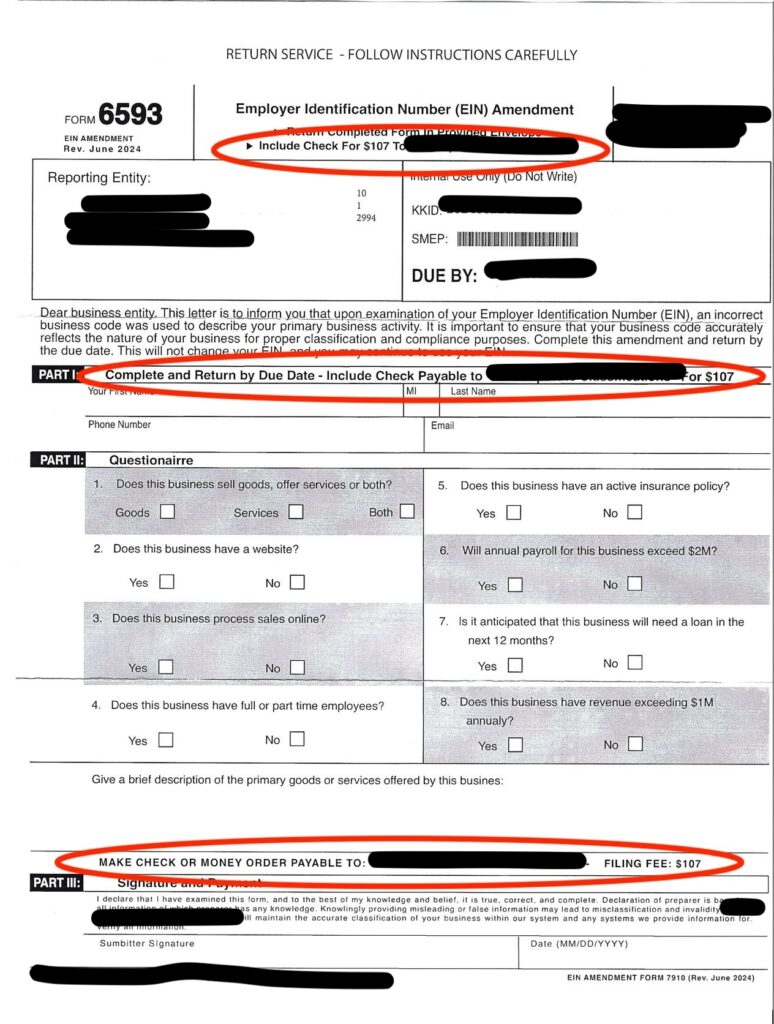

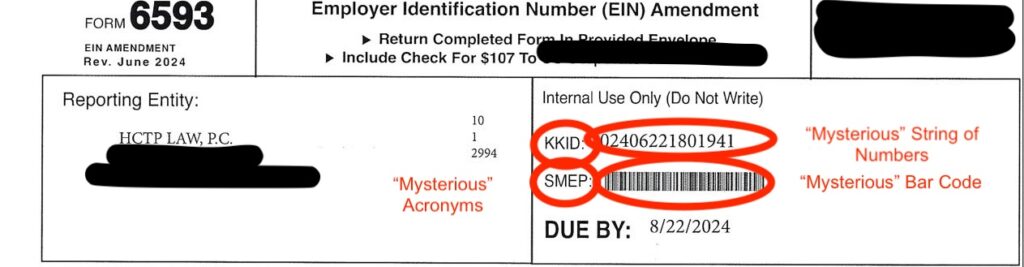

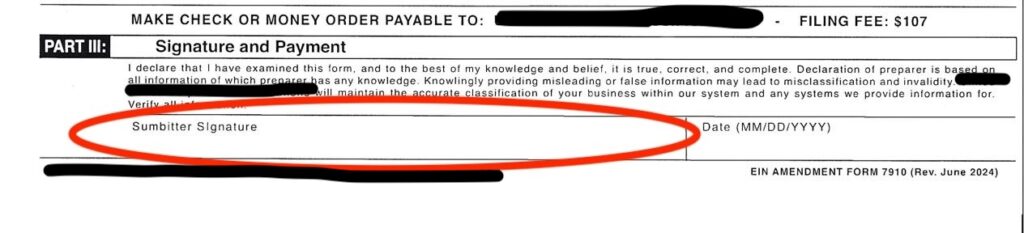

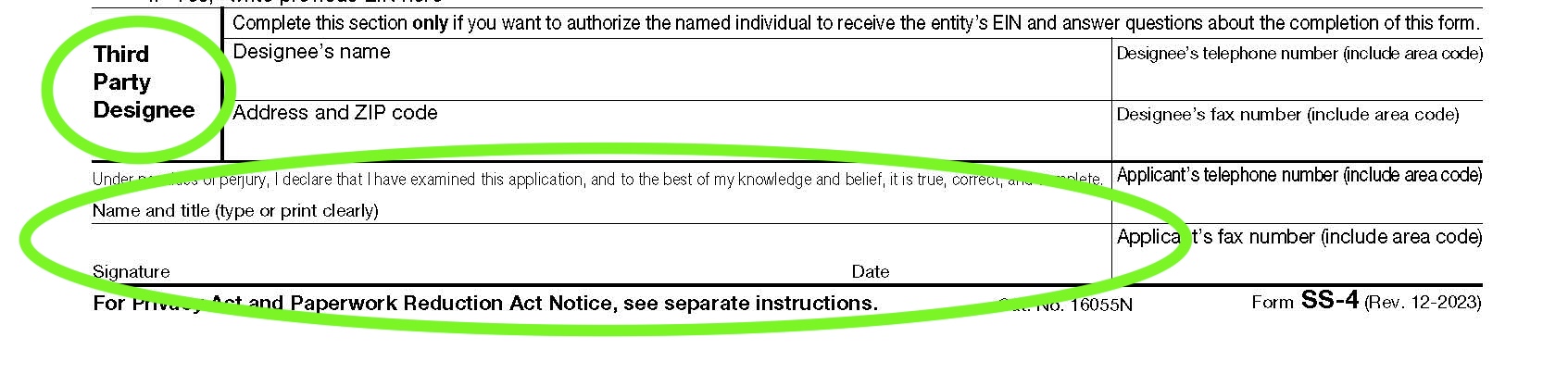

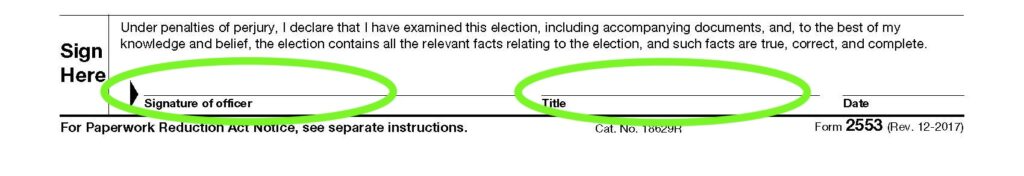

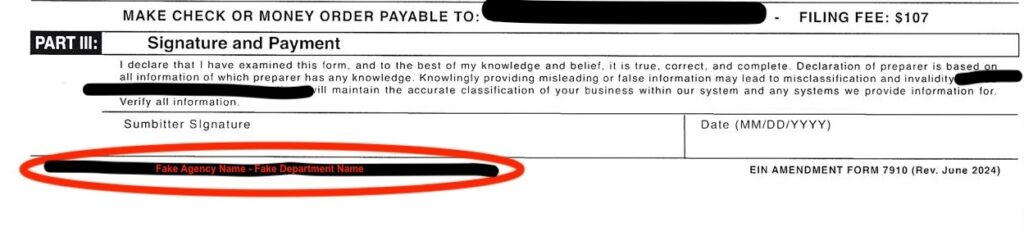

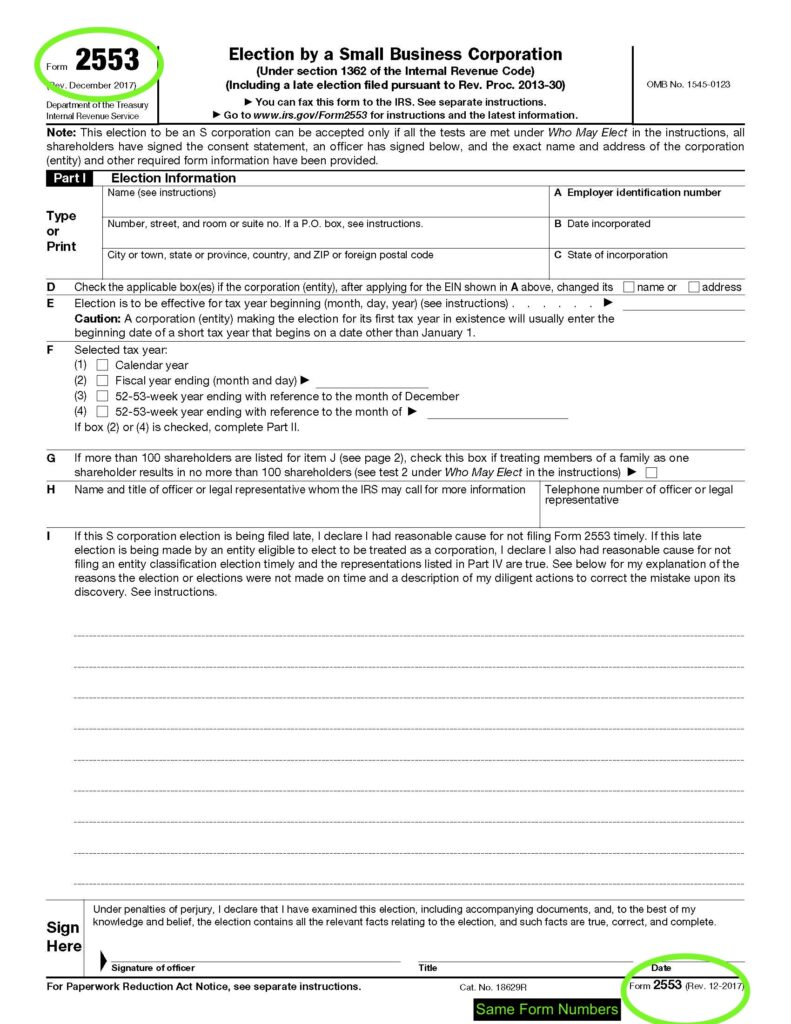

Images with red circles are from a real scam form sent to HCTP Law. Images with green circles are from the most current revisions of IRS Form SS-4 and IRS Form 2553. To prevent an increase of confusion about the scammer/fake agency, all images from the fake form have the name of the scammer/fake agency redacted.

No Information on the Government Entity/Fake Name

The first sign of a fake government form scam is not knowing what department or agency the form came from. Scammers will use official sounding organization names like “United States Business Regulations Department.” A quick search on the internet can help determine if these are real government agencies. The key is to look for “.gov” at the end of the website address. United States government websites also include a banner stating it is an official website of the United States government.

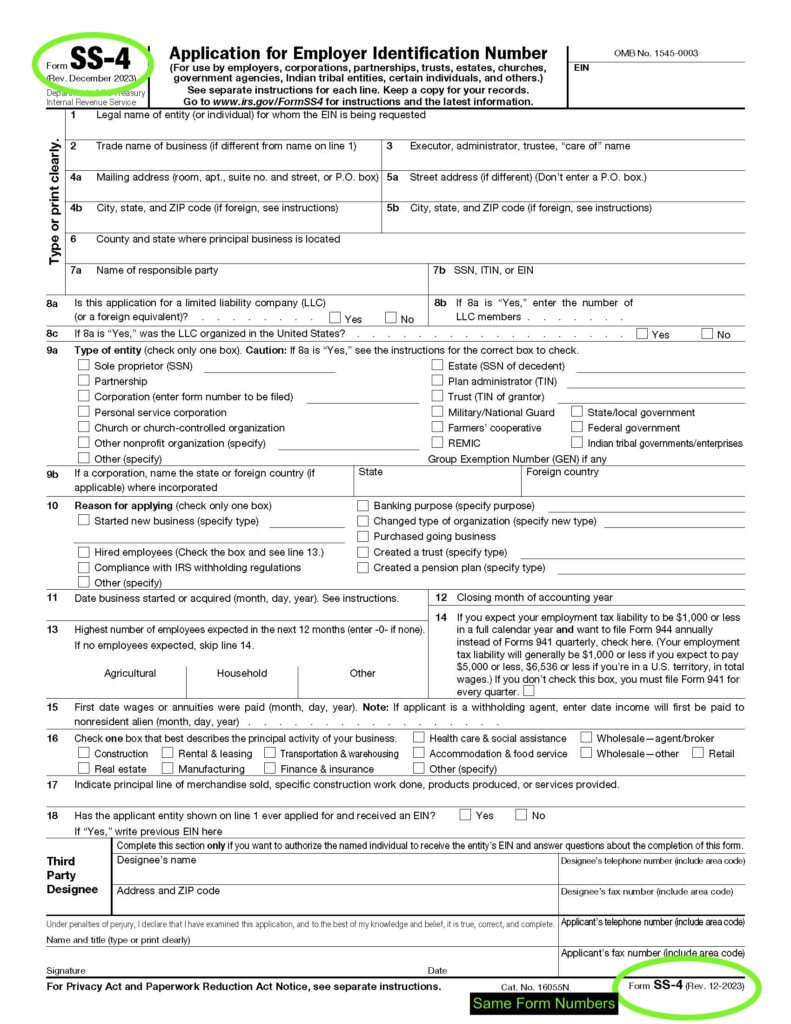

No Instructions in the Title Box

The second sign when dealing with fake forms is no reference to instructions. Nearly all legitimate forms from the IRS have an instructions document or supplementing publications to help the individual preparing the form. Additionally, many forms from the IRS or SEC have a specific Office of Management and Budget (OMB) number located in the form’s header to the right of the title box.

Strange Formatting

The third way takes a keen eye for detail. Small errors in document formatting can help reveal a form’s fraudulent nature. Some examples include using “ALL CAPS” instead of only capitalizing the first letter for certain parts of a form or placing a revision date in the wrong place.

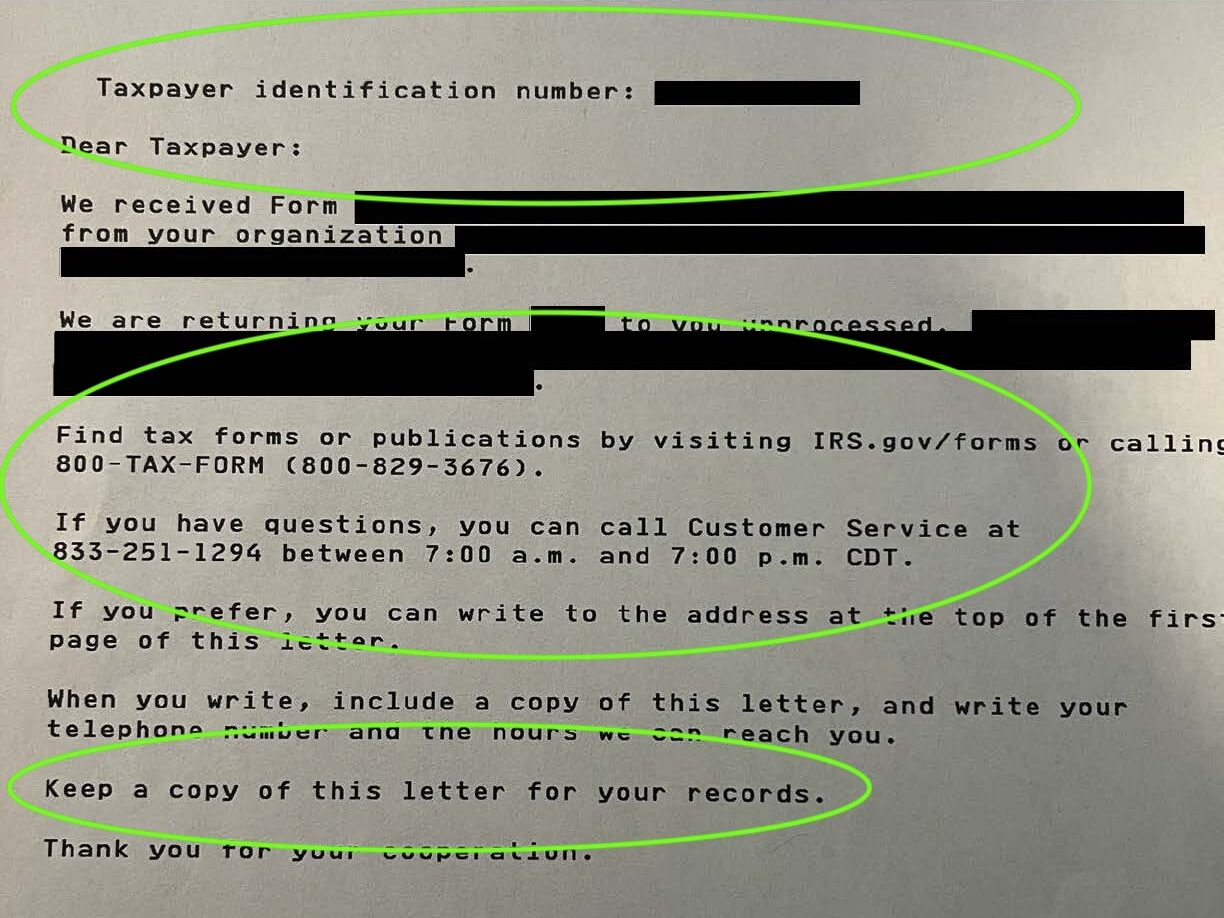

No Cover Letter/Returned Form

The fourth method is that your form didn’t come with a letter explaining why you received the form or that the letter is inside the form itself. If a previously filed form was done so in error, the government agency will often send back the rejected form alongside the reason for rejection and next steps, including where to send the letter. The agency will usually provide several contact methods in their letter and suggest that you keep a copy for your records. Scammers may enclose a self-addressed letter envelope with the form. Don’t be fooled! If you can’t find the filing address in the form and there is no return address on the original envelope, it may be a scam.

Additional Tip: Search internet for the address on the enclosed return envelope. Nearly every government building is a registered location on internet based maps and applications. If what you find is a random address or vacant lot, it’s probably a scam!

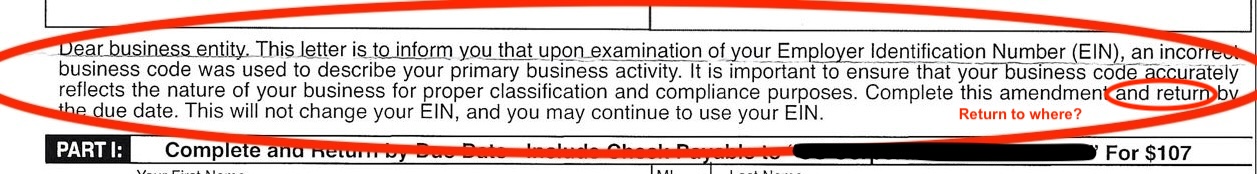

Urgent Demands for Payment

The fifth sign of a scam is an urgent or repeated demands for payment. Scammers try to instill fear into their victims to provoke them to quickly act without thinking. Large and bold print due dates and repeated requests for specific amounts by money order or check are ways scammers try to get their victim’s attention.

While there are due dates for many filings, the government generally does not care immensely over your timely submission of a filing fee. It is the individual’s or business’s responsibility to timely file forms, not the government. Scammers are concerned with collecting quickly from victims to make their money.

Mysterious Acronyms and Numbers

The sixth way to spot a scam is the form including deceptive but “official-looking” acronyms and numbers. Some fake forms will try to trick victims by using fake three or four letter acronyms with a code or number next to it signifying some identification like the business organization date or Secretary of State Business ID–which, in Indiana, is publicly available using the Indiana Secretary of State’s InBiz Business Search–or a mysterious bar code.

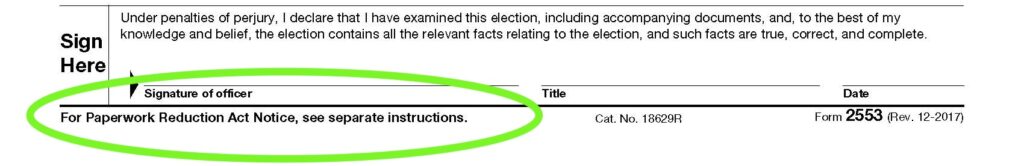

Odd Signature Request

The seventh sign of a fake government form is an odd signature request. In order to file a form with the government, the actual person, attorney-in-fact, or authorized agent (if a business entity) must sign and date the form. Businesses require the signature and title of an officer of the business, like the president or treasurer. Likewise, if someone is signing on behalf of an individual, they will have to sign as a third party or preparer of the form and usually have to submit an additional authorization form alongside the filing.

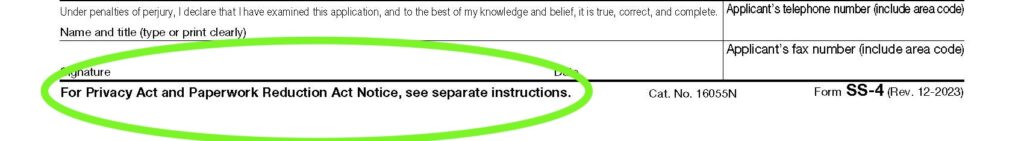

No Privacy Act/Paperwork Reduction Act Notice

The eighth way is that there is no notice about the Privacy Act or Paperwork Reduction Act. Personal Identifying Information (PII) like your Social Security Number (SSN) or Taxpayer/Employer Identification Number (TIN/EIN) that can be used to steal your identity are protected under the Privacy Act and must be kept and maintained to provide those privacy protections. Forms requiring PII usually include a Privacy Act notice.

Additionally, most government form filing has transitioned to nearly or completely require online or e-filing. Forms that can be securely submitted online often includes a Paperwork Reduction Act notice. Not seeing one or both of these notices can be a sign of a fraudulent form.

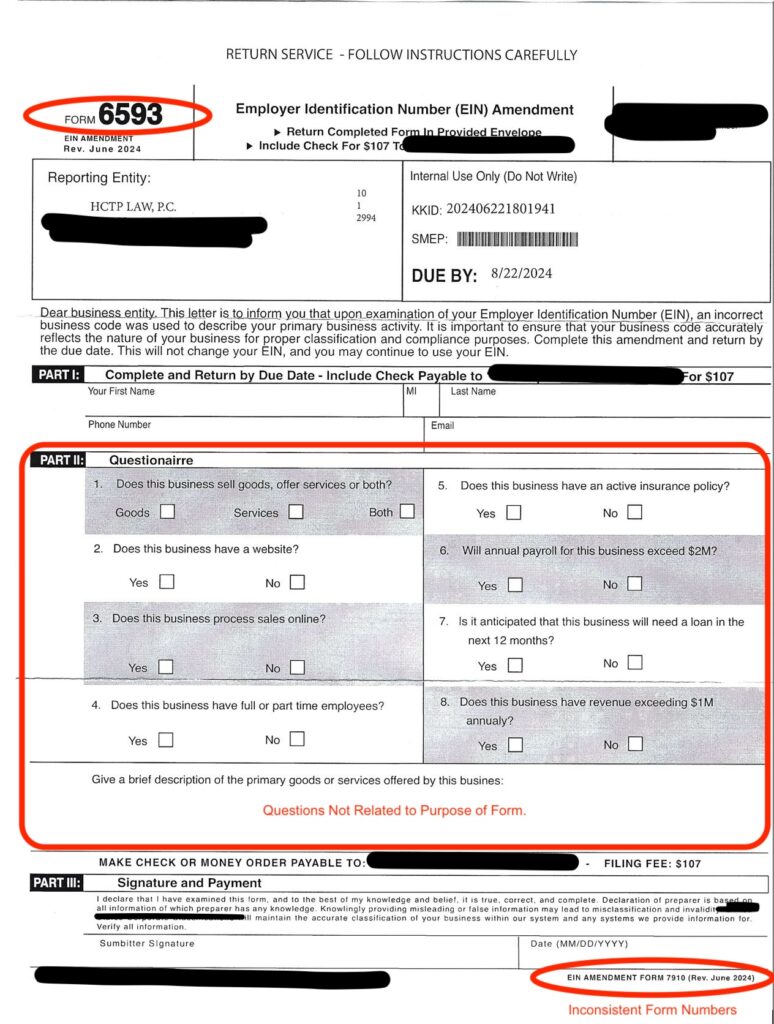

It’s Confusing/Makes No Sense

The ninth way to spot a scam form is that it makes no sense. The form can be filled with errors like misspellings, grammatical errors, or inconsistent form numbers. Real government forms go through revisions based on changes in the law and will rarely have these inconsistencies.

Additionally, the information requested by the form can be unusual, overly invasive, or completely off-topic from the form’s stated purpose.

Fake form scams use a person’s lack of knowledge about the law to confuse them in hopes of provoking unquestioned action. Government forms can be tedious and time consuming, but every form has some type of purpose. A scam form may demand a change to an account or business but state that no major changes will actually be made. If the form doesn’t have a stated purpose with a reason, it may be a scam.

Form Doesn’t Exist

The tenth method is searching the government form registries. The quickest way to know if the form is legitimate is to check government websites. Government forms that are meant to be completed by individuals and businesses will often be publicly available with a complete list of all available forms and publications. Here are some links to a few government form lists:

If your form isn’t recognizable on a government website, it may be fake!

What Do I Do If I Have a Fake Form?

First, do not complete the form and return it. You can submit reports of scams and fraud to the Federal Bureau of Investigation (FBI) or Federal Trade Commission (FTC). If you are not sure which to report to, you can visit this official United States government scam reporting website to help you determine where to report.

Additionally, you can contact an attorney or a government office to help verify whether a form is a scam.